Alternative Sweeteners & Sugar Substitutes Market to Hit 33.6 billion Dollars by 2033 as Sugar Declines says, SRI

Rising lifestyle diseases, clean label trends, and rapid innovation are pushing alternative sweeteners into a 33.63 billion dollar global market by 2033.

LONDON, UNITED KINGDOM, UNITED KINGDOM, November 25, 2025 /EINPresswire.com/ -- Alternative Sweeteners & Sugar Substitutes Market to Hit 33.6 billion Dollars by 2033 as Sugar Declines says, Strategic Revenue Insights (SRI)London, UK - November 2025 | Strategic Revenue Insights Inc. The global food economy is undergoing a decisive shift as consumers rethink their relationship with sugar, and businesses respond by reformulating products at an unprecedented pace. The Alternative Sweeteners and Sugar Substitutes market has rapidly moved from niche to necessity, reshaping the strategies of food and beverage giants, healthcare brands, and wellness innovators. This transformation is captured in detail in the latest analysis of the industry, available at Alternative Sweeteners & Sugar Substitutes Market. What is clear from the data is that alternative sweeteners are no longer framed as optional add ons. They sit at the center of a profound shift in nutritional science, public health priorities, and commercial product development. Rising lifestyle diseases, regulatory pressure, clean label movements, and global nutrition awareness are converging to propel the category into a new era of expansion and innovation.

Market Trends Reshaping Consumer Expectations and Industry Strategy

The ecosystem surrounding alternative sweeteners has become increasingly complex and more dynamic than ever before. Trends once limited to diet conscious consumers have now permeated mainstream food culture. Governments are tightening sugar taxation policies. Retailers are prioritizing low sugar and sugar free formulations. Fitness and wellness brands are marketing reduced calorie alternatives as a differentiator. These trends together have ignited a structural transformation across the supply chain.

One of the defining shifts is the move toward clean label natural sweeteners. Consumers are scrutinizing ingredient lists more than ever and demanding recognizable, plant derived, minimally processed inputs. Stevia, monk fruit, agave, erythritol, and allulose have all gained traction because they align with this preference for nature-based formulations. Brands that once leaned heavily on aspartame or sucralose are now expanding into natural options that promise similar sweetness profiles with fewer perceived risks.

The shift goes beyond diet concerns and reaches into broader wellness narratives that prioritize holistic nutrition, transparency, and ingredient integrity.

https://www.strategicrevenueinsights.com/industry/alternative-sweeteners-sugar-substitutes-market

Another powerful trend is the rise in functional sweeteners used to enhance nutritional value. Companies are experimenting with fibers, prebiotic formulations, and metabolic support compounds that deliver sweetness while supporting digestive and immune health. This redesign of sweeteners as wellness components is blurring the line between flavoring agents and functional additives.

In addition, consumer behavior is becoming more differentiated across regions. In North America and Europe, the movement toward natural alternatives is primarily driven by health concerns and regulatory restrictions on artificial sweeteners. In Asia Pacific, rising middle class populations are driving demand for sugar reduction as part of broader shifts toward Western style packaged foods and increased healthcare awareness. Latin America, with some of the world’s highest sugar consumption rates, is experiencing accelerated adoption of sugar substitutes due to aggressive government policies. The market trends are synchronized by a shared global challenge but shaped locally by different cultural, economic, and demographic drivers.

Browse the associated report:

https://www.strategicrevenueinsights.com/kr/industry/alternative-sweeteners-sugar-substitutes-market

https://www.strategicrevenueinsights.com/ja/industry/alternative-sweeteners-sugar-substitutes-market

https://www.strategicrevenueinsights.com/pt/industry/alternative-sweeteners-sugar-substitutes-market

https://www.strategicrevenueinsights.com/it/industry/alternative-sweeteners-sugar-substitutes-market

https://www.strategicrevenueinsights.com/es/industry/alternative-sweeteners-sugar-substitutes-market

https://www.strategicrevenueinsights.com/da/industry/alternative-sweeteners-sugar-substitutes-market

https://www.strategicrevenueinsights.com/de/industry/alternative-sweeteners-sugar-substitutes-market

https://www.strategicrevenueinsights.com/fr/industry/alternative-sweeteners-sugar-substitutes-market

Technological Advancements Transforming Sweetener Innovation

Technological innovation is now at the heart of product development in this market. Companies are moving far beyond traditional extraction techniques and embracing modern biotechnological processes that allow them to scale production, improve quality, and reduce environmental impact. Biotechnology has emerged as the most transformative force by enabling manufacturers to develop natural tasting, zero calorie sweeteners through controlled fermentation processes. These approaches reduce reliance on agricultural land, minimize input variability, and create far more consistent taste profiles.

Precision fermentation is playing a pivotal role in the next generation of sweeteners such as allulose and rare sugar compounds. These compounds closely mimic the sensory attributes of sugar while delivering a fraction of the calories. Their taste profile has a more rounded sweetness curve compared to stevia or monk fruit, which often carry bitter or metallic aftertastes. As a result, food manufacturers are increasingly adopting precision fermented sweeteners to create sugar free formulations that consumers cannot distinguish from sugar sweetened products.

Smart processing technologies are also reshaping the way sweeteners are refined, stabilized, and packaged. Microencapsulation techniques protect heat sensitive and volatile compounds, allowing them to be incorporated into baked goods and high temperature applications without degrading. This opens new categories for manufacturers who historically avoided natural sweeteners because of functional constraints.

Packaging technologies are evolving as well. Smart packaging that integrates QR codes and digital traceability tools is helping brands reinforce consumer trust by showcasing sourcing information, sustainability metrics, and ingredient purity. These innovations collectively elevate the industry, enabling the production of sweeteners that are more stable, more scalable, and more marketable than previous generations.

Sustainability Challenges That Require Industry Wide Reform

While alternative sweeteners often carry a health halo, their sustainability story is more complex. Growing global demand has placed pressure on agricultural systems and production facilities that rely on water intensive crops or complex manufacturing processes. Understanding these environmental implications is essential for assessing long term viability.

Stevia cultivation, for example, requires significantly less land compared to sugarcane but still demands efficient irrigation systems. Some reports indicate that poorly managed stevia farms can consume more than 5500 liters of water per kilogram of dried leaves, which raises concerns about scalability in water scarce regions. Additionally, the extraction process for natural sweeteners often involves solvents, resin systems, and energy intensive equipment, creating a notable carbon footprint if not responsibly managed.

Artificial sweeteners raise a different set of sustainability questions. Studies have shown that compounds like sucralose can pass through wastewater treatment systems and accumulate in aquatic ecosystems. Research published in multiple environmental journals has documented detectable levels of sucralose in rivers, highlighting the need for improved degradation methods and regulatory oversight. Although artificial sweeteners require less agricultural land, their long term environmental persistence is a challenge.

To address these issues, producers are investing in new sustainable farming techniques, water efficient drip irrigation, renewable energy powered extraction facilities, and biodegradable processing materials. Furthermore, biotechnology is reducing reliance on agricultural land entirely by creating sweeteners through controlled microbial fermentation that requires far less water. Lifecycle analysis tools are being used across the industry to quantify carbon, water, and energy footprints, enabling companies to set more accurate sustainability targets.

The industry still faces difficult questions about supply chain transparency, end of life environmental impact, and the carbon intensity of refined sweeteners. However, sustainability focused innovations are accelerating, driven by public scrutiny and the growing expectation that brands must minimize ecological impact while improving human health.

Comprehensive Market Analysis Showing Accelerated Global Momentum

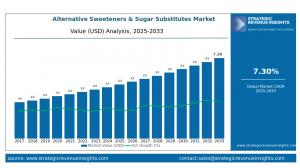

The market for alternative sweeteners has entered a phase of sustained, long term expansion driven by consumer behavior changes, health policy evolution, and scientific advances. The market was valued at 17.84 billion dollars in 2024 and is projected to reach 33.63 billion dollars by 2033, reflecting a compound annual growth rate of 7.30 percent. This growth outpaces many other food ingredient categories and positions sweeteners as one of the most resilient and strategically important markets in the global food system.

Natural sweeteners dominate the growth trajectory. Stevia and monk fruit together account for a rapidly expanding share of retail and industrial use because they align with health and clean label trends. Allulose is emerging as one of the fastest growing segments due to its near identical taste profile to sugar and favorable metabolic characteristics. Artificial sweeteners still hold a significant presence in mass market beverages and pharmaceuticals, but their growth is slower due to ongoing consumer perception challenges.

Regionally, Asia Pacific is becoming the most important market due to rising disposable incomes, changing diets, and domestic health campaigns aimed at reducing sugar intake. North America remains a leader in product innovation, while Europe continues to refine regulatory standards that influence global manufacturing practices.

The competitive landscape features major players such as Cargill, ADM, Tate & Lyle, Ajinomoto, PureCircle, Roquette, and Ingredion. These companies are deeply invested in R and D pipelines focused on taste optimization, clean label formulation, and scalable biotechnological production. Mergers, acquisitions, and strategic partnerships are becoming common as companies attempt to broaden portfolio strengths. Retail private label brands are also entering the market, particularly in natural sweeteners, leveraging strong consumer trust in organic and minimally processed lines.

Future Outlook Driven by Regulation, Innovation, and Shifting Demographics

Looking ahead, the industry is poised for even more rapid transformation as regulatory landscapes evolve and new demographics influence consumer behavior. Governments worldwide are introducing sugar taxes, marketing restrictions for sugary foods, and labeling requirements that highlight added sugars. These regulatory tools are pushing manufacturers to reformulate at scale and accelerating adoption of alternative sweeteners.

Technological improvements will continue to create sweeteners that are functionally identical to sugar, closing the gap between consumer expectations and low calorie formulations. Advances in biosynthetic pathways, fermentation technologies, and flavor modulation are likely to reduce aftertaste issues, enabling natural sweeteners to perform better in mainstream categories like dairy, carbonated beverages, and ready to eat snacks.

Demographics will also reshape demand. Younger consumers are far more proactive about sugar reduction, wellness, and plant based choices. Older populations facing metabolic health concerns are seeking sugar free options with medical validation. E commerce will expand global access, making premium sweeteners available in economies where distribution barriers previously limited adoption.

The industry will also see stronger convergence between sweeteners, functional foods, and personalized nutrition. Manufacturers may increasingly design sweeteners tailored to metabolic responses, microbiome health, and glycemic control. These innovations will redefine the very purpose of sweeteners, expanding them from taste enhancers to metabolic tools.

The Growing Importance of Alternative Sweeteners in a Changing World

Alternative sweeteners and sugar substitutes have become central to global food innovation, public health strategy, and commercial product development. Their growth reflects a deeper structural change in how societies perceive nutrition, wellness, sustainability, and consumer transparency. The ongoing evolution of the sector illustrates the intersection between health science, technology, agriculture, and retail behavior. Companies seeking to navigate the future of food must understand both the opportunities and the challenges shaping this market. For readers interested in exploring broader research and strategic insights across global industries, additional resources are available at Strategic Revenue Insights.

Related Reports:

https://www.strategicrevenueinsights.com/industry/alginate-alternatives-market

https://www.strategicrevenueinsights.com/industry/alternative-and-complementary-medicine-market

https://www.strategicrevenueinsights.com/industry/alternative-data-market

https://www.strategicrevenueinsights.com/industry/alternative-data-solution-market

https://www.strategicrevenueinsights.com/industry/alternative-flours-market

https://www.strategicrevenueinsights.com/industry/alternative-food-market

https://www.strategicrevenueinsights.com/industry/alternative-fuel-market

https://www.strategicrevenueinsights.com/industry/alternative-fuel-and-hybrid-vehicle-market

https://www.strategicrevenueinsights.com/industry/alternative-protein-fermentation-market

https://www.strategicrevenueinsights.com/industry/alternative-protein-substitutes-market

https://www.strategicrevenueinsights.com/industry/alternative-sugar-market

https://www.strategicrevenueinsights.com/industry/alternative-sweetener-market

https://www.strategicrevenueinsights.com/industry/alternative-waters-market

About Us:

Strategic Revenue Insights Inc., a subsidiary of SRI Consulting Group Ltd, empowers organizations worldwide with data-driven market intelligence. Headquartered in London, United Kingdom, we deliver syndicated research reports, tailored consulting solutions, and actionable insights that equip clients to make confident, future-focused strategic decisions.

Our team of seasoned analysts—based in London and connected globally—continuously tracks markets, identifies emerging trends, and uncovers growth opportunities to support long-term client success. As part of SRI Consulting Group Ltd, we are committed to accuracy, clarity, and practical relevance, helping businesses navigate competitive landscapes, optimize strategies, and accelerate revenue growth.

By combining rigorous research methodologies with deep industry expertise, Strategic Revenue Insights Inc. provides organizations with a comprehensive market perspective that drives measurable results and sustained competitive advantage.

Media Contact:

Company Name: Strategic Revenue Insights Inc.

Contact Person: Ashwani

Email: sales@strategicrevenueinsights.com

Phone: +44 7877403352

Address: Suite10 Capital House 61 Amhurst Road, E8 1LL

City: London

State: London

Country: United Kingdom

Website: www.strategicrevenueinsights.com

Website: www.strategicpackaginginsights.com

Website: www.sriconsultinggroupltd.com

Rohit Bhisey

Strategic Revenue Insights Inc.

+44 7877403352

sales@strategicrevenueinsights.com

Visit us on social media:

LinkedIn

Facebook

X

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.